In the latest insights piece of our ongoing series, Leading for a changed future – what are your ‘AHA’ moments, we explore the complex landscape of compliance management in the new working world. How can an enterprise-wide compliance mindset help mitigate the potential risks for your organisation in a changed future? Find out more.

Compliance management has always been complicated, even before the crisis. Now, on the precipice of the most significant shift and profound change in management thinking, global leaders face new challenges in maintaining compliance while managing a newly emerging elastic workforce.

Moving forward, developing comprehensive processes around effective compliance will be even more critical. And this starts with encouraging an enterprise-wide compliance-first culture, where employees at every level accept responsibility over risk management.

Compliance in a changing world

Gone are the days where compliance sits as the sole responsibility of a compliance officer or single department. As the world is increasingly digital, there are unique challenges and new risks that must be addressed. Non-compliance can be devastating, as highlighted in the fallout from the Banking Royal Commission report.

Non-compliance directly impacts leaders as they are seen as ultimately responsible. From fines to an irreversible loss of reputation, non-compliance isn’t something to take lightly.

Customers also lose trust and faith in a company if they feel their rights are not protected, leading to further financial losses. This, in turn, negatively impacts employee morale which leads to reduced productivity, high employee turnover, and the inability to attract stronger talent to fill gaps. In the current environment, with worsening business conditions, this is the last thing any company needs.

An enterprise-wide team effort

It’s time for leaders to operationalise compliance across the entire enterprise. This means integrating risk management into every level of the business process, including it in the outcome-based activities of your people and ensuring they put it to use.

To then get your company to embrace compliance at every level, the first step is acknowledging the importance of compliance and what it means in the context of the new working world.

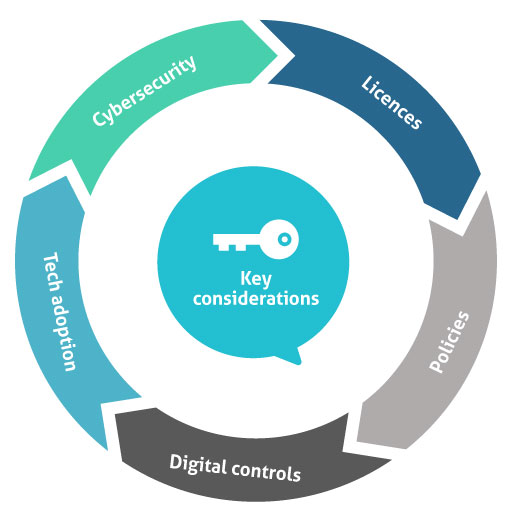

Leaders should ask: do you have the right licenses for a remote workforce? Does your current policies address confidentiality standards outside the office? How are you adapting digital controls to meet obligations remotely? Are you safely fast-tracking the adoption of new digital tools? How are you mitigating increased cyber risks in a rapidly digitalising world? And the list goes on.

So, how can leaders ensure they embrace the new world safely and securely with confidence and peace of mind when it comes to compliance? The answer lies in having the support of the full workforce.

Here are five critical steps you can immediately take to ensure your enterprise stays compliant:

1. Devise policies that address new gaps in compliance

The new working model requires new thinking around compliance. Leaders must ensure that internal policies cover issues like maintaining device security, cordoning off virtual meeting rooms, protecting employee privacy while observing performance remotely and more.

2. Promote a compliance-first culture

Leaders must start from the top down, setting an example for a positive compliance mindset, encouraging employees to take ownership over processes and enabling increased integration between departments to create a shared sense of responsibility.

3. Deploy appropriate tools and training

You must invest in your people by providing training to use any new digital tools effectively. The 2019 TAS Compliance Index found that nearly 40 per cent of financial services organisations provided less than a day’s training on compliance and 17per cent of firms still used Microsoft Excel as their primary compliance management tool.

4. Adopt strategic partnerships

Collaboration is critical in meeting compliance challenges head-on and reducing the strain on the organisation and its people. Partnerships allow leaders to quickly assess, review and deploy purpose-fit solutions that help automate processes and reduce the risk of human error.

5. Review all of your third-party partners

Don’t just focus on your internal processes – the compliance activities of third parties will also impact your ability to meet obligations. The TAS Index also highlighted a severe gap here with over 20 per cent of organisations reliant on external service providers to offer insight into their activities.

The importance of building a more digital-ready, and operationally-resilient business has found new significance. As we transition into the next phase of the crisis, leaders will feel more pressure to ramp up digital transformation and investment into the elastic workforce. However, failing to manage compliance during this will expose organisations to devastating risks

Put compliance worries at ease with the right support. To explore how Enlighten can help, reach out to one of our executives, Helen Mackay, at helen.mackay@enlighten-opex.com for a virtual coffee chat.